Due to the recent market volatility, I’ve been getting a lot of inquiries on how to change or switch their Sun Life VUL fund allocation. For starters, VUL is an insurance with investment component that is actually invested either in the stock market, government bonds, money market or a combination of any.

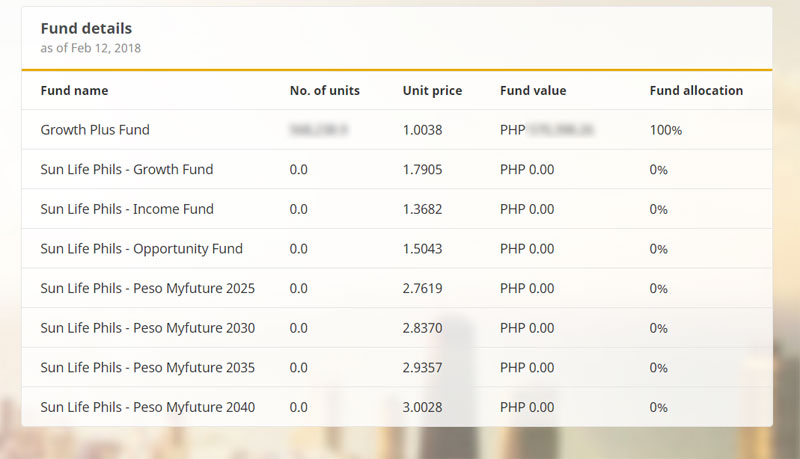

If you’re not yet sure where your VUL fund allocation is, just simply log on to your My Sun Life Client Account <formerly Sun Link Online account>, scroll down to Fund details and you should be able to see something like the images below.

Here, it says that the fund allocation is 100% Growth Plus Fund.

< If you don’t have a Sun Life Client Account yet, register your Sun Life policy by following these steps >

Just a little review on the Fund Allocation options.

If your VUL policy is any of the following, these are the options you can choose.

| VUL Type | VUL Name | Choose any or combination of the following |

|---|---|---|

| Regular and Limited Pay VUL (Peso) | Sun Flexilink Sun Flexilink1 Sun Maxilink Prime Sun Maxilink Bright | Balanced Fund Bond Fund Equity Fund Growth Plus Fund Index Fund Captains Fund Opportunity Tracker Fund MyFuture 2025 Fund MyFuture 2030 Fund MyFuture 2035 Fund MyFuture 2040 Fund |

| Regular or Single Pay VUL (Dollar) | Sun Flexilink Dollar Sun Flexilink Dollar1 | Global Income Fund Global Advantage Fund |

| Single Pay or GIO VUL (Peso) | Sun Maxilink One Sun Maxilink One Age 71 to 80 | Opportunity Fund Income Fund Growth Fund Growth Plus Fund Index Fund Captains Fund Opportunity Tracker Fund MyFuture 2025 Fund MyFuture 2030 Fund MyFuture 2035 Fund MyFuture 2040 Fund |

| Single Pay or GIO VUL (Dollar) | Sun Maxilink Dollar One Sun Maxilink Dollar One Age 71 to 80 | Global Income Fund Global Opportunity Fund |

I’ll try to write on a separate article the definitions and features of each fund. For now, let’s focus on how to switch from one fund to another in case you find the need for it.

In making VUL Fund Switches, it’s also important to take note of the following

- VUL Fund Switches are FREE of charge up to 4 times per year

- You will be charged 1% on the amount of switched funds in excess of 4.

- VUL Funds unlike stocks should not be traded

So here are the things you need in order to make a Fund Switch on your VUL Policy

- VUL – Request for Fund Switching / Allocation and Excess Premium Form

- Signature of Policy Owner

- Signature(s) of Irrevocable Beneficiary(ies) if any

- One valid Gov’t Issued ID of Policy Owner AND Irrevocable Beneficiary(ies) if any

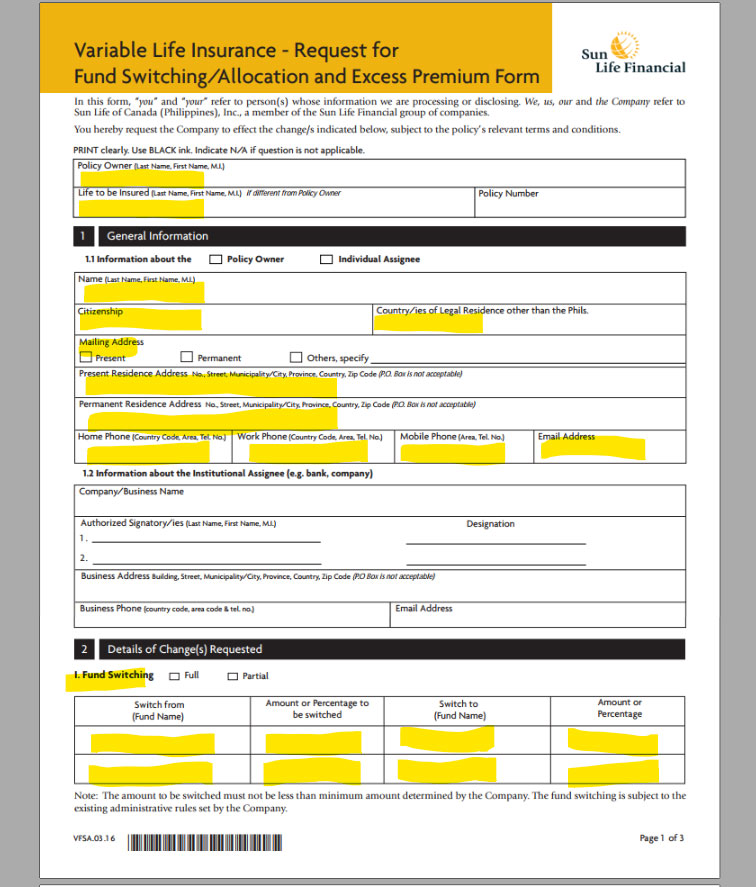

Let’s take a look at the VUL Fund Switching / Allocation and Excess Premium Form

You need to fill in the following

- Policy Owner (Last Name, First Name, M.I.)

- Life to be Insured (Last Name, First Name, M.I.) – fill this up if Policy Owner is different from insured. If not, just put N/A

- Policy Number

Under 1. General Information, fill in the following under 1.1

- Name

- Citizenship

- Country/ies of Legal Residence other than the Phils – if any. Otherwise just put N/A

- Mailing Address – check whichever you prefer

- Present Residence Address

- Permanent Residence Address – if different from present address. If not, just put ‘same as present address’

- Home Phone

- Work Phone

- Mobile Phone

- Email Address

1.2 – Fill this in if it’s a Company Owned policy – that is company is the payor and employees are the insured. If not, just leave this blank.

2. Details of Change(s) Requested

- Choose whether you’re making a Full fund switch or just Partial

- Under Switch From, put the Current Fund Name

- Under the Amount or Percentage to be switched, write either Amount or Percentage.

- Under the Switch To (Fund Name), put the desired Fund Name

- Under the Amount or Percentage to be switched, write either Amount or Percentage.

For example Current Fund name is Balanced Fund and you want to Switch 100% to Index.

Write Switch From – Balanced Fund, 100%, Switch to – Index Fund, 100%.

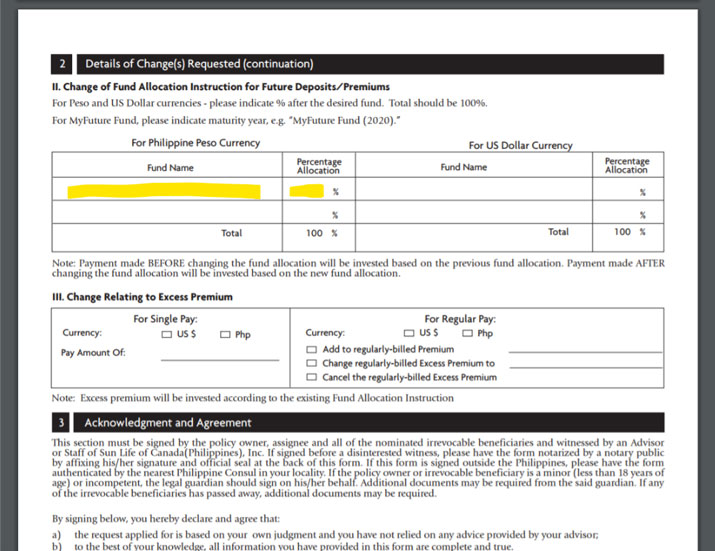

Please take note that this will affect what ever the current fund value is and not Future Deposits/Premium. But if you want to make the changes to Future Deposits/Premium, you must continue to filling up Page 2

Page 2 is where you put Change of Fund Allocation for Future Deposits / Premiums.

- Under Fund Name, simply put where you want Future Deposits / Premiums to be allocated

- Under Percentage Allocation, simply put the percentage

For example, you want all Future Deposits/Premiums to be allocated in Index Fund, just put Index Fund under Percentage Allocation, 100%

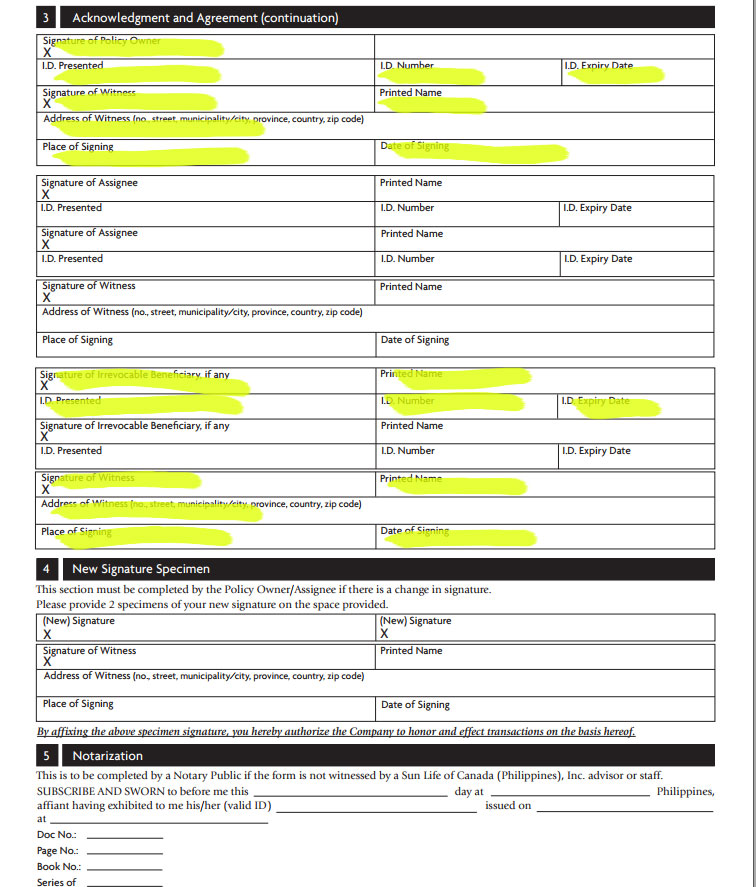

And finally, here’s Page 3

Details here are self explanatory. You basically need the Signatures and valid ID’s (1 only) of the following

- Policy Owner

- Witness

- Irrevocable Beneficiaries (if any)

This is where your Sun Life Financial Advisor plays a big role. In case this will be submitted directly to any Sun Life stores and offices without the knowledge of your original or any Sun Life Financial Advisor, you’ll have to accomplish item No. 5 – Notarization.

But if you still have an active Sun Life Financial Advisor, you can simply ask him to submit it on your behalf and he/she can be the witness.

<In case your Sun Life Financial Advisor is no longer active, has resigned or you’re no longer in contact with, I might be able to help you handle your account FREE of charge>.

After you completed the requirements, you can then submit your requirements to Switch or Change the Fund Allocation of your Sun Life VUL Policy.

Should you have questions, feel free to send me message.

Garry De Castro is a personal finance advocate, Financial Advisor, Certified Investment Solicitor (Mutual Fund Representative), investor, stock market trader, blogger, and IT practitioner. He started sharing and writing financial articles 2008 just to share his financial learnings to friends, relatives and anyone who wishes to be financially independent.